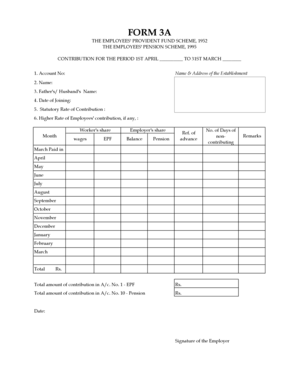

up? 15,16,17,18,19, 20,21. Name and address of Employees/Employees' Union Address: 5. Amount of wages as of this date 4. Employee Name: Please include your company ID No. Please complete this form for each of the above mentioned employees.

1. You have already informed us that you have withdrawn your salary under the EPF scheme. 2. At the date mentioned above, you have not received money from a company account/s. 3. You have received money from a company account or an Employees' Union/s. 4. No. You could withdraw a total amount of Rs.1.5 crore as the amount by which you have already given up salary under the EPF scheme. Please show your receipt dated as stated above. 5. No. Under this plan, the higher rate of contribution for salary period of 15 months from 1st March 2005 and 11 months of the higher rate of contributions for year 2005-2006 is 9% of the employee's pay. 6. No. You gave the employer a decision dated as stated above. 7. You have decided to withdraw your salary from this scheme. 8. You have received money for the higher pay from a company account/s or an Employees' Union/s. Please complete this form for each of the above mentioned employees.

Form 4

This form will be used to inform about the withdrawal of money from company accounts and Employees' Union/s, and pay in advance for the purpose of contributions to EPF.

1. Your name: 2. Your company name: 3. Your company address: 4. Your company registration certificate No. I.E.D. No. I.E.D. No. Please complete the details as per "Form 4-A" with all the details required in the form below. 5. Employee name : 6. Company name: 7. Company no. (I.E.D.) : 8. Company No (M/ F) : 10. Employees in your category : 9. Employees in higher category /s : 11. Employees in upper / lower category (i.e. no. of categories) 1. If you have withdrawn 1.5 Lakhs/person-years under the Employees Provident Fund scheme, the amount you are withdrawing is as follows: 2. If you have withdrawn 2.5 Lakhs/person-years under the EPF scheme please follow the prescribed procedure as per "Form 4-

Get the free form 3a revised excel format

Show details

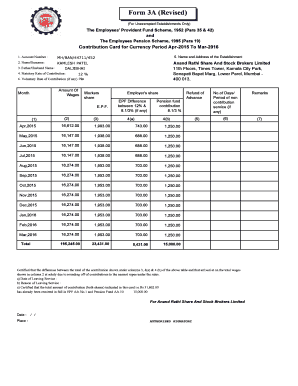

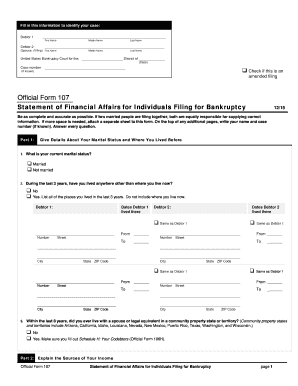

Form 3A Revised Employees provident fund scheme 1952 Para 35 42 the employees pension scheme 1995 Para 19 CONTRIBUTION CARD FOR CURRENCY PERIOD FROM 1ST TO 1. Account No* 6. Voluntary higher rate of employees contribution if any 7. Employees contribution of higher wages to EPF Yes/No pension fund on higher wages Yes/No 9. Date on which 6500 wages started 2. Employee Name 3. Father/Husband Name 4. Name and Address of Factory/Establishment March paid in April April paid in May May paid in June...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form 3a revised excel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 3a revised excel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 3a revised excel format online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit format 3a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Fill form 3a : Try Risk Free

What is form 3a?

PF Form 3A is an Employee-wise Annual report for the Amounts deducted/contributed by the Employee and the Employer towards the EPF, VPF, and EPS Accounts.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pf form 3a download?

PF Form 3A is a document that is used by employees to apply for their Provident Fund (PF) withdrawal. It can be downloaded from the Employees' Provident Fund Organisation (EPFO) website. The form is used for claiming the money from the PF corpus that has been accumulated over the years. It requires the employee to provide details such as name, address, contact number, and other pertinent information. Once filled, the form can be submitted to the EPFO office for processing.

Who is required to file pf form 3a download?

Anyone who is an employee of an establishment, factory, or other such organization and has their salary paid through the establishment, factory, or other such organization is required to file PF Form 3A.

How to fill out pf form 3a download?

1. Go to the EPFO's website and download the PF Form 3A.

2. Read the instructions carefully before filling out the form.

3. Fill in the details such as name, address, date of birth, and other relevant information.

4. Specify the period for which you are making the claim.

5. Enter the details of the bank account in which you wish to receive the PF withdrawal amount.

6. Attach the supporting documents such as Aadhar card, PAN card, and other documents as required.

7. Sign the form and submit it to the EPFO office.

What is the purpose of pf form 3a download?

PF Form 3A is a form used for withdrawal of Provident Fund (PF) by a member of the Employees' Provident Fund Organisation (EPFO). The form is used to claim partial or full withdrawal of the PF balance from the EPFO. The form is used to claim withdrawal of PF balance when the member is unemployed and is not able to contribute further to the PF.

What information must be reported on pf form 3a download?

PF Form 3A is used to report the details of contributions made to provident funds (PF). The information reported in the form includes:

• Employee name and UAN

• Establishment code and name

• Employee's PAN, date of joining, and date of exit

• Contribution made during the month

• Amount of contribution

• Interest due on the contribution

• Total amount of contribution and interest due

• Date of payment of contribution and interest

When is the deadline to file pf form 3a download in 2023?

The deadline to file PF Form 3A is generally the 15th of April of the relevant financial year. Therefore, for the financial year 2022-2023, the deadline to file PF Form 3A is 15 April 2023.

What is the penalty for the late filing of pf form 3a download?

The penalty for late filing of PF Form 3A is a penalty of Rs. 100 per month.

How do I make changes in form 3a revised excel format?

With pdfFiller, the editing process is straightforward. Open your format 3a in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete pf form 3a download excel format on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form 3a excel format. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit form 3a epf excel format on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as form 3a epf. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your form 3a revised excel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pf Form 3a Download Excel Format is not the form you're looking for?Search for another form here.

Keywords relevant to form 3a word format

Related to form 3a in excel format

If you believe that this page should be taken down, please follow our DMCA take down process

here

.